Frequently asked questions?

Still have any question? Please contact our sales team

Contact our sales teamA Comprehensive Identity and Business Verification for your business with Enhanced Due Diligence.

Modern banking systems require secure and reliable identity verification tools. Our Video Recording KYC API enables real-time video-based customer verification for financial institutions by capturing and recording live video interactions as part of the KYC process.

This powerful API helps banks verify customer identities with visual confirmation, enhancing the onboarding process and meeting regulatory compliance for Video KYC, while reducing fraud and ensuring the presence of a real user.

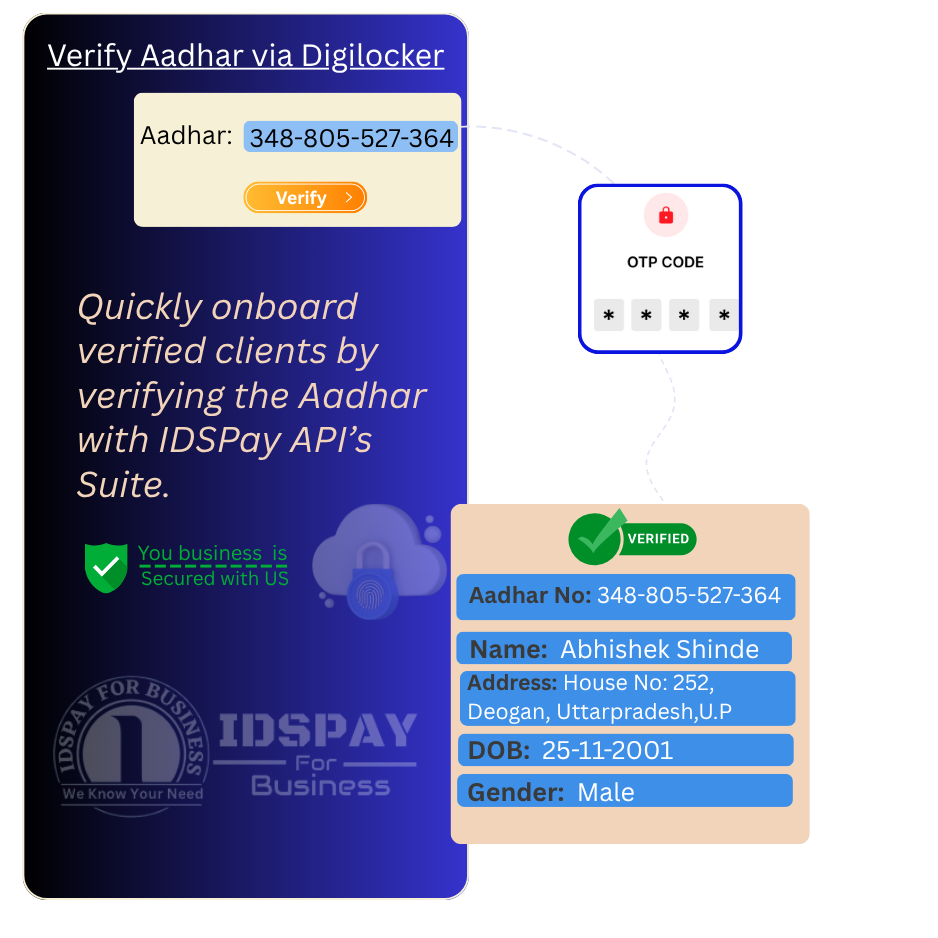

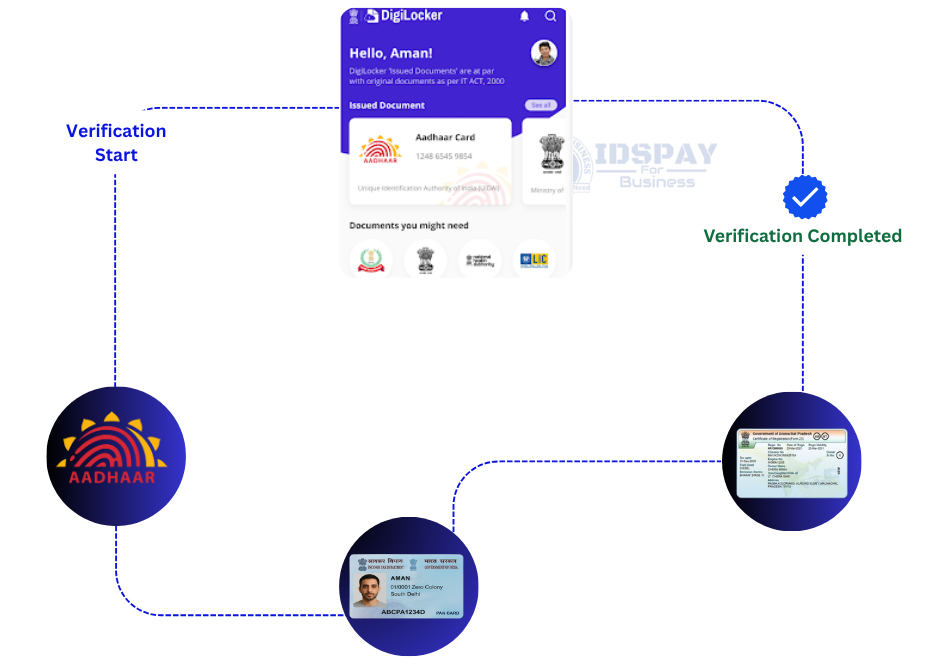

The tool supports fully digital and paperless operations by recording live video sessions, capturing user details, and validating them against official ID documents—such as Aadhaar, PAN, or other government-issued IDs.

Whether opening accounts, processing loan applications, or verifying high-risk customers, Video Recording KYC provides a secure, compliant, and efficient verification experience for both banks and customers.

Embrace digital transformation in banking with our compliant, scalable, and easy-to-integrate Video Recording KYC API solution.

Fully compliant with RBI and SEBI guidelines for Video KYC, ensuring your verification process meets legal and regulatory standards.

Capture and verify customer identity through live video interaction, confirming liveness and intent in real time.

Video recordings help detect and prevent impersonation, deepfakes, and identity fraud through live human presence verification.

Enables secure, end-to-end digital onboarding without the need for physical visits or paperwork.

Video recording KYC is one of the most crucial security measures in modern KYC systems to onboard the verified customer, and hence, Video Recording KYC API is essential for the digital onboarding process.

Read MoreEnables real-time video interaction with the customer, capturing and recording the session as part of the KYC process.

Confirms the user is physically present and interacting live, reducing the risk of impersonation or pre-recorded video fraud.

Meets RBI and SEBI guidelines for Video KYC, ensuring your process adheres to legal and audit standards.

All video sessions are securely recorded and stored with encryption, providing an audit trail for future verification or regulatory review.

Still have any question? Please contact our sales team

Contact our sales team