Frequently asked questions?

Still have any question? Please contact our sales team

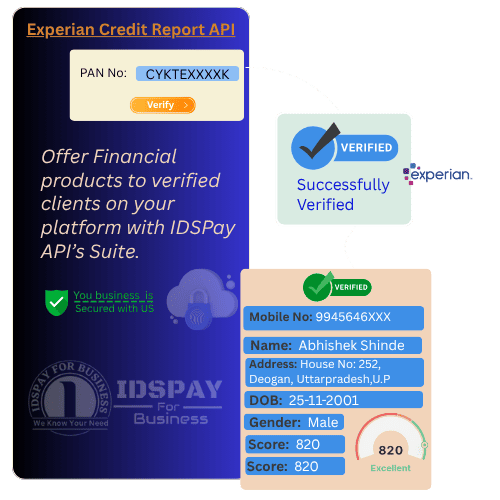

Contact our sales teamA Comprehensive Solution for financial credits details verification to provide the loan and advances securely to your customer's with Enhanced Due Diligence.

Key Benefits of Using IDSPay’s Crif Report API

✅️ Verified data directly Experian

✅️ 99.9% uptime with secure authentication

✅️ Developer-friendly API documentation

✅️ Comprehensive Credit Insights

✅️ Ideal for NBFCs, fintech startups, digital lenders, and microfinance companies

The Experian Credit Report API from IDSPay enables financial institutions, NBFCs and fintech platforms in India to retrieve real-time, comprehensive credit reports directly from Experian’s trusted bureau data. With this API you gain access to credit score, repayment history, account status, credit utilisation, inquiries and risk indicators — all in a secure, developer-friendly REST interface.

Automate your credit onboarding, enhance risk assessment, reduce defaults and accelerate loan approvals with India’s most efficient Experian Credit Report API solution.

With the Experian Credit Report API, you can automate credit checks, reduce fraud, ensure compliance, and enhance user experience—all while making faster, smarter credit decisions.

Get real-time access to detailed credit reports and scores for faster decision-making..

Leverage accurate credit data directly from Experian, one of India's leading credit bureaus.

Eliminate manual credit evaluation with automated, API-driven workflows.

Access repayment history, credit utilization, and inquiry data to better evaluate creditworthiness.

The Experian Credit Report API is a secure and consent-based service that allows businesses to retrieve an individual's credit report and credit score directly from Experian, one of India's major credit bureaus. It provides instant access to key financial indicators like repayment history, credit utilization, account status, and past inquiries.

Read MoreFetches up-to-date credit reports and scores instantly from Experian.

Access to credit data is fully compliant, requiring user consent as per regulatory guidelines.

Includes credit score, repayment history, credit utilization, open and closed accounts, and recent inquiries.

Enables credit report retrieval using the customer’s Permanent Account Number (PAN).

Still have any question? Please contact our sales team

Contact our sales team