Frequently asked questions?

Still have any question? Please contact our sales team

Contact our sales teamA Comprehensive Identity and Business Verification for your business with Enhanced Due Diligence.

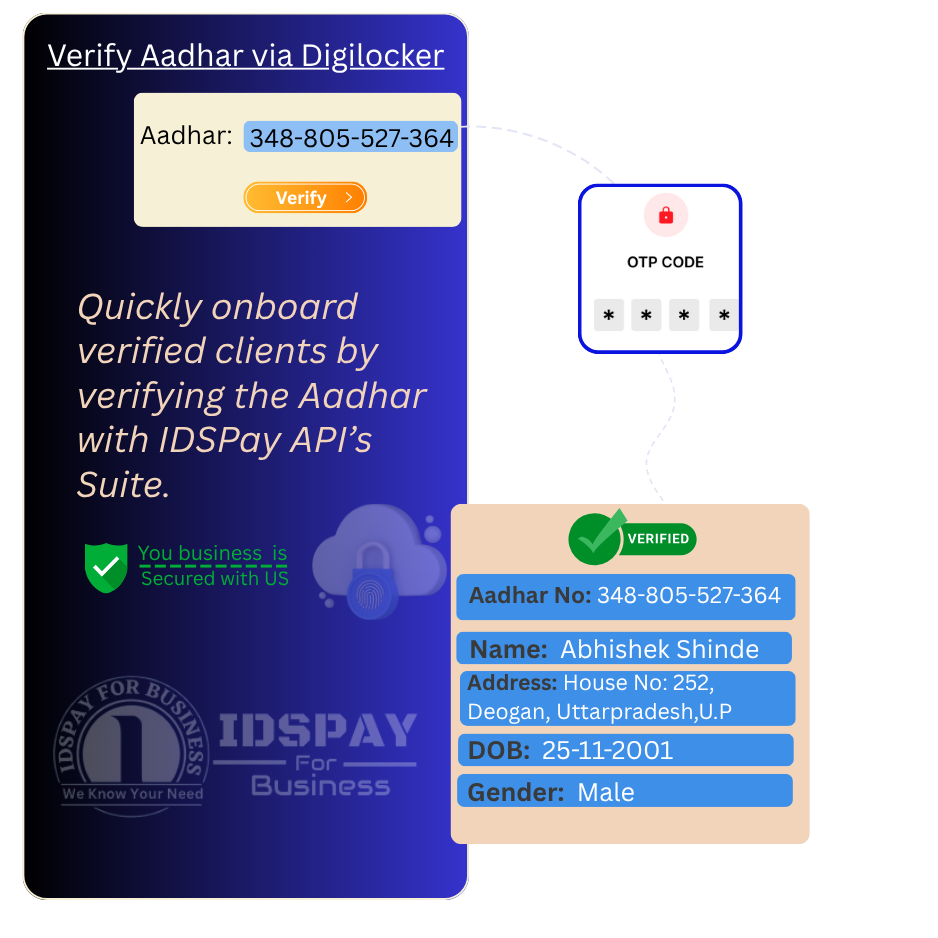

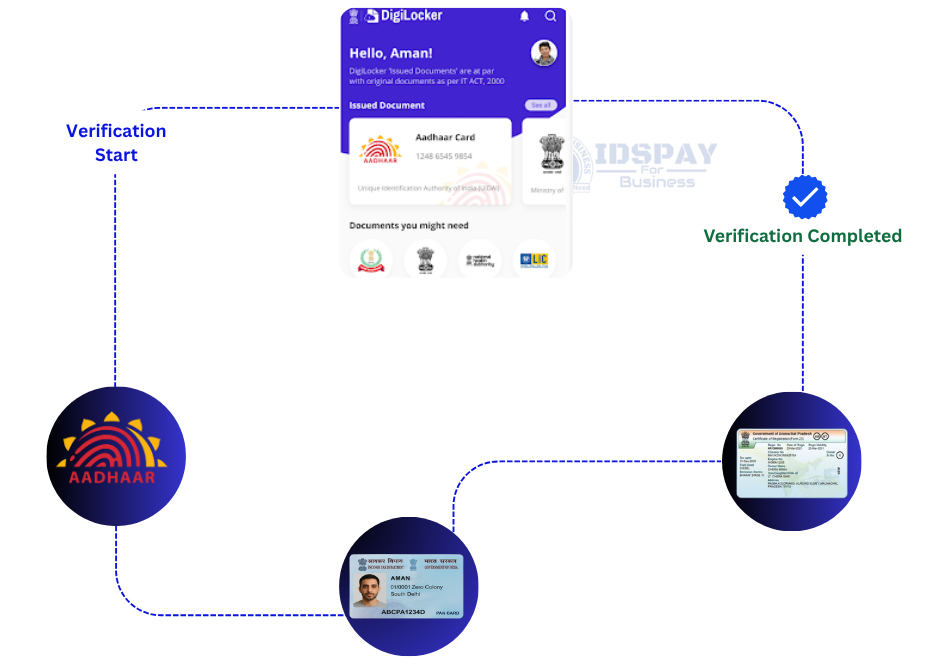

Modern banking systems demand accurate and efficient identity verification tools. Our PAN-based API, seamlessly integrated via DigiLocker, enables real-time PAN card authentication for financial institutions.

This robust API allows banks to instantly verify customer identities, streamlining onboarding processes and ensuring enhanced compliance with KYC regulations—while minimizing manual errors and mitigating fraud risks.

The solution enables paperless operations by validating critical customer details such as name, PAN number, and date of birth—vital components for financial verification.

Whether it's account creation, credit evaluation, or investment verification, PAN authentication provides a fast, secure, and fully digital experience for both banks and customers.

Accelerate your digital transformation in banking with our reliable, scalable, and easy-to-integrate PAN verification solution.

Authenticate Pan data securely and eliminate identity fraud in financial operations.

Verify Pan numbers in real time for quick and paperless onboarding processes.

Ensure compliance with RBI norms using authenticated government-issued IDs.

Enable mobile-first Pan authentication across digital banking platforms.

PAN verification is one of the most crucial security measures in modern KYC systems to onboard the verified customer, and hence, PAN Verification API is essential for the digital onboarding process.

Read MoreInstant verification of pan number and account information, providing immediate results for seamless user experience and faster transaction processing.

AI-powered fraud detection algorithms analyze patterns and behaviors to identify suspicious activities and prevent fraudulent transactions before they occur.

Simple RESTful API with comprehensive documentation makes it easy to integrate banking verification into your existing applications and workflows.

Round-the-clock technical support and monitoring to ensure your banking verification services are always running smoothly and efficiently.

Still have any question? Please contact our sales team

Contact our sales team