Frequently asked questions?

Still have any question? Please contact our sales team

Contact our sales team- Linked

- Not Linked

- Invalid PAN/Aadhaar

- Error in Processing

A Comprehensive Identity and Business Verification for your business with Enhanced Due Diligence.

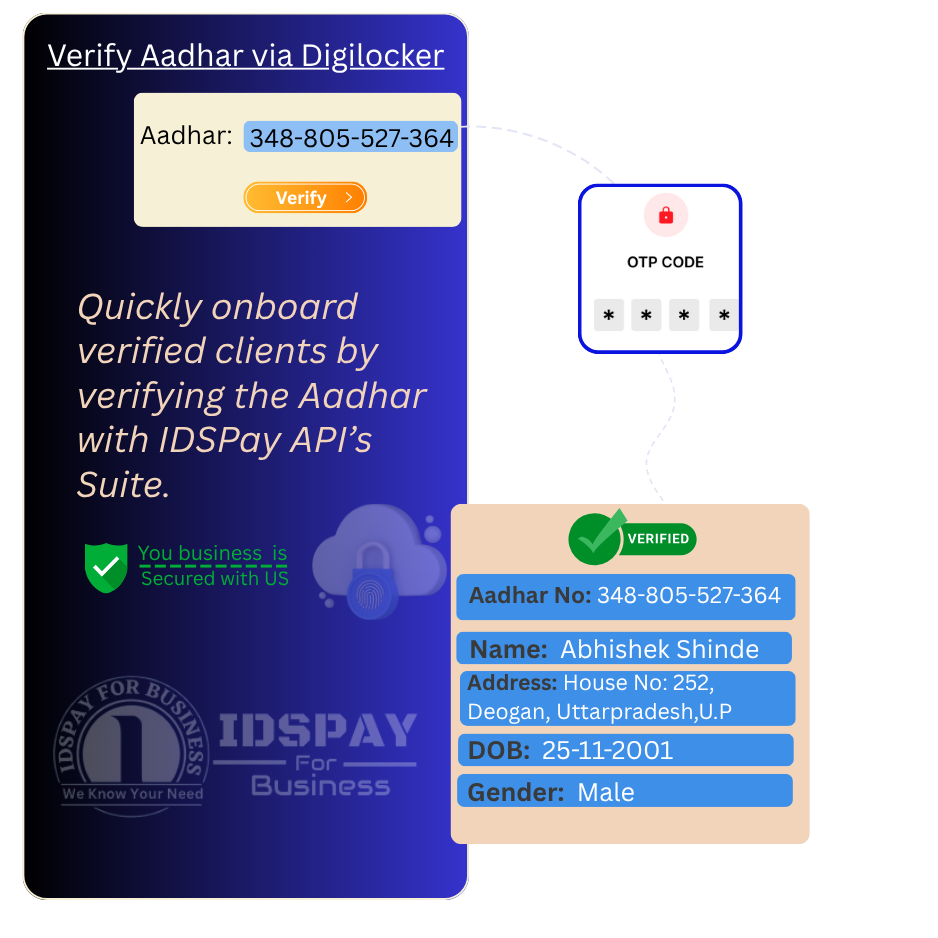

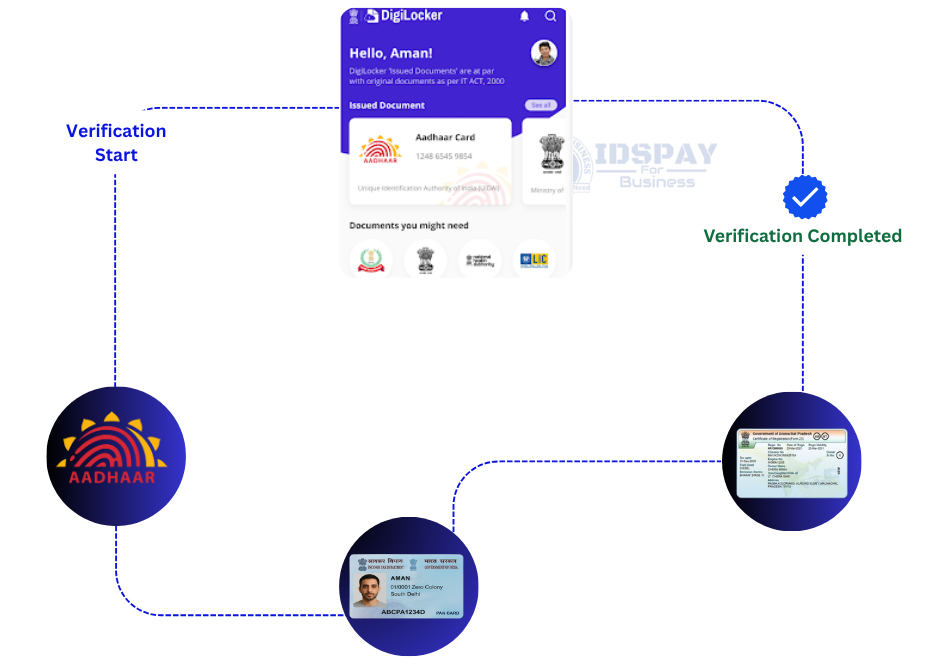

Modern banking systems require accurate and compliant identity verification. Our PAN-Aadhaar Link Status API, integrated via DigiLocker and official government systems, enables financial institutions to instantly check whether a customer’s PAN is linked with their Aadhaar—critical for regulatory compliance and financial services access.

This efficient API streamlines verification by retrieving real-time linkage status, helping institutions prevent transaction failures, delays in tax filings, or service disruptions due to unlinked PAN and Aadhaar records.

By automating this check, banks and fintechs can reduce manual processing, eliminate errors, and enhance the onboarding experience—all while staying aligned with government mandates.

Whether you're opening accounts, processing investments, or enabling tax-related services, our PAN-Aadhaar Link Status API ensures that your customer data is accurate, verified, and ready for seamless integration.

Support your compliance and verification needs with a secure, scalable, and easy-to-integrate PAN-Aadhaar linkage status solution—built for modern digital infrastructure.

Verifying PAN-Aadhaar linkage helps meet mandates set by the Income Tax Department of India. Unlinked PANs may become inoperative, affecting legal and financial operations.

Linked PAN and Aadhaar ensure that financial services such as account openings, investments, or tax filings don’t face delays or rejections due to invalid or inactive PANs.

Real-time verification of linkage status helps accelerate KYC and onboarding processes, making them smoother and more efficient for both customers and institutions.

Automated status checks minimize manual verification efforts, reducing human error and saving valuable operational time.

PAN-Aadhaar Link Status API is a digital service that allows financial institutions to instantly verify whether a customer’s PAN (Permanent Account Number) is linked with their Aadhaar number. This linkage is mandated by the government for tax compliance and is essential for accessing various financial services.

Using this API helps institutions ensure regulatory compliance, avoid processing delays, and prevent the use of inoperative or invalid PANs—making it a vital tool for seamless onboarding, accurate KYC, and secure financial transactions.

Read MoreInstantly checks if a customer’s PAN is linked with their Aadhaar through official government databases.

Delivers real-time results with high accuracy to support quick decision-making during onboarding or transaction processing.

Requires only basic input (like PAN number and/or Aadhaar number) for quick status retrieval.

All API requests and responses are handled over secure, encrypted connections, ensuring customer data protection.

Still have any question? Please contact our sales team

Contact our sales team