Frequently asked questions?

Still have any question? Please contact our sales team

Contact our sales team- KYC status

- PAN-Aadhaar link status

- PEP classification

- Watchlist/sanctions list inclusion

A Comprehensive Identity and Business Verification for your business with Enhanced Due Diligence.

Modern banking systems demand full regulatory compliance and real-time risk assessment. Our Compliance Status API enables financial institutions to instantly verify a customer’s financial compliance standing across key regulatory checkpoints.

This powerful API simplifies due diligence by retrieving real-time data related to KYC status, PAN-Aadhaar linkage, PEP (Politically Exposed Person) lists, watchlists, and other risk indicators—ensuring that institutions remain fully aligned with evolving compliance mandates.

By automating compliance checks, banks and fintechs can reduce manual overhead, mitigate financial and reputational risk, and onboard customers faster and more securely.

Whether you’re conducting risk profiling, processing high-value transactions, or fulfilling AML obligations, the Compliance Status API delivers a fast, secure, and paperless compliance workflow.

Stay audit-ready and risk-aware with our scalable, reliable, and developer-friendly Compliance Status API—designed for the regulatory demands of modern finance.

Helps meet KYC, AML, and FATF guidelines by instantly validating a customer’s compliance standing—reducing the risk of regulatory penalties.

Provides instant access to data like PAN-Aadhaar linkage, KYC status, PEP screening, and watchlist checks, enabling faster and more accurate decision-making.

Automates complex compliance checks that would otherwise require multiple manual lookups—saving time, effort, and operational costs.

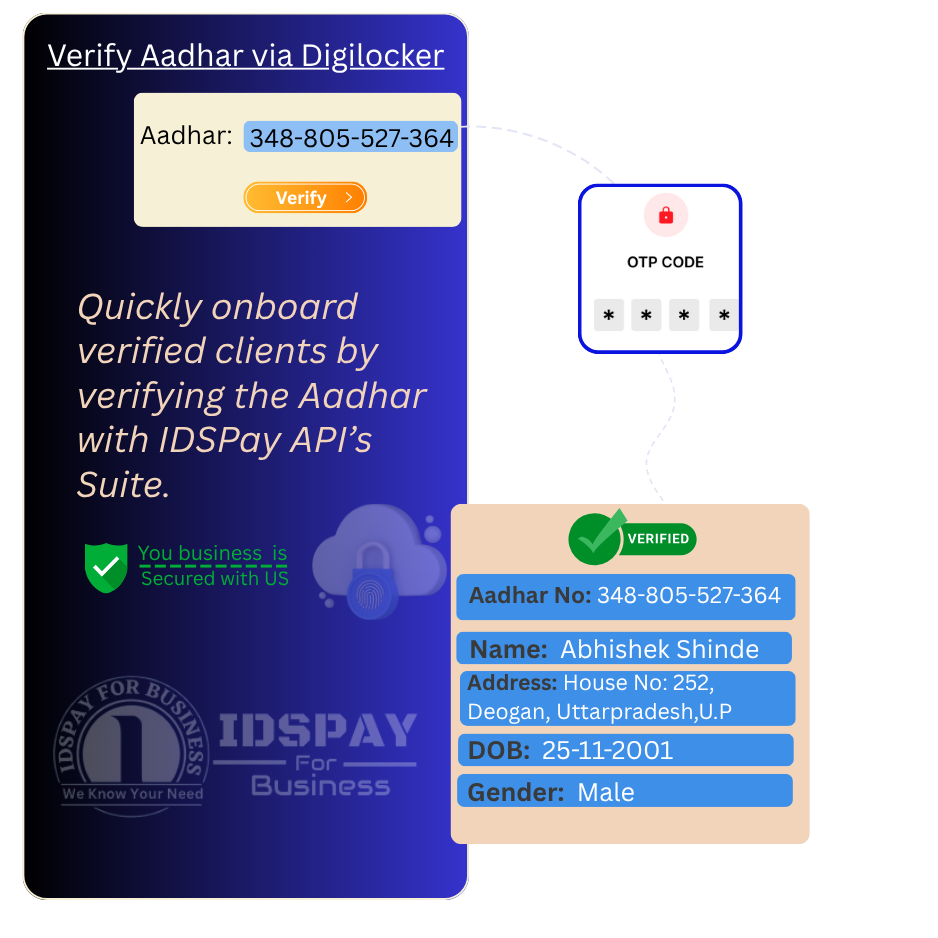

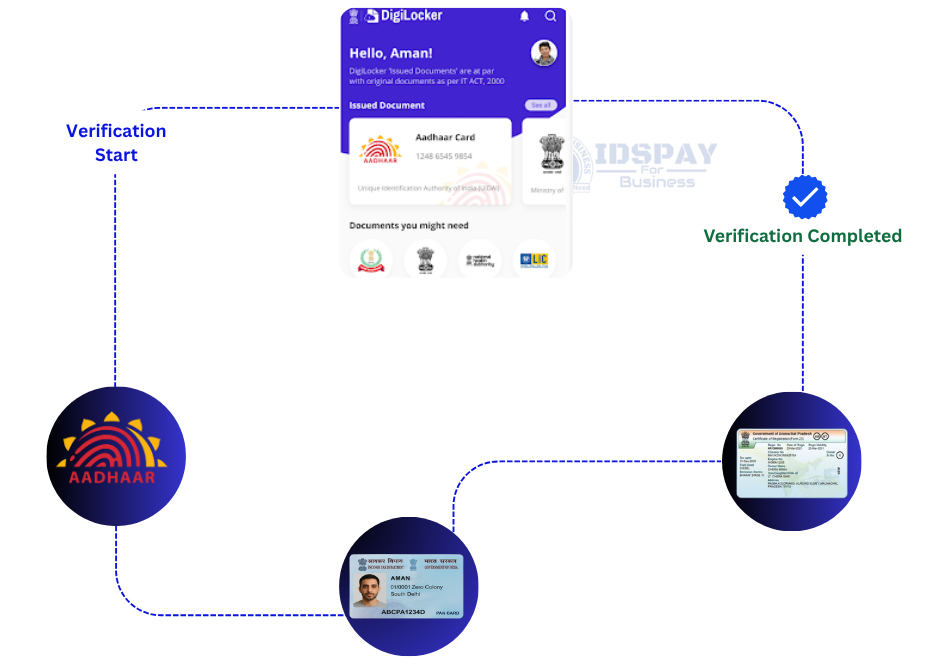

Accelerates the onboarding process by confirming compliance eligibility in real time, creating a smooth and frictionless user experience.

Compliance Status API is a real-time verification service that helps financial institutions assess whether a customer meets essential regulatory and risk-related requirements. It checks data points like KYC status, PAN-Aadhaar linkage, PEP (Politically Exposed Person) classification, and presence on watchlists.

This API is critical for ensuring regulatory compliance, preventing financial fraud, and enabling secure onboarding, especially in highly regulated sectors like banking, lending, and investments.

Read MoreInstantly checks whether the customer’s KYC is active, pending, or incomplete across regulated financial systems.

Verifies if the customer’s PAN is linked with Aadhaar, a mandatory requirement for tax compliance and financial services.

Identifies if a customer is classified as a PEP or high-risk individual, helping institutions comply with AML norms.

Delivers instant compliance results, enabling faster onboarding, risk profiling, and customer verification.

Still have any question? Please contact our sales team

Contact our sales team