Frequently asked questions?

Still have any question? Please contact our sales team

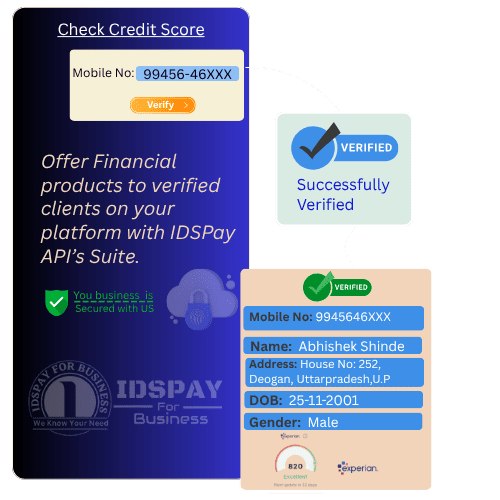

Contact our sales teamA Comprehensive Solution for financial credits details verification to provide the loan and advances securely to your customer's with Enhanced Due Diligence.

Key Benefits of Using IDSPay’s Experian Credit Score API

✅️ Verified data directly from Experian

✅️ 99.9% uptime with secure authentication

✅️ Developer-friendly API documentation

✅️ Ideal for NBFCs, fintech startups, digital lenders, and microfinance companies

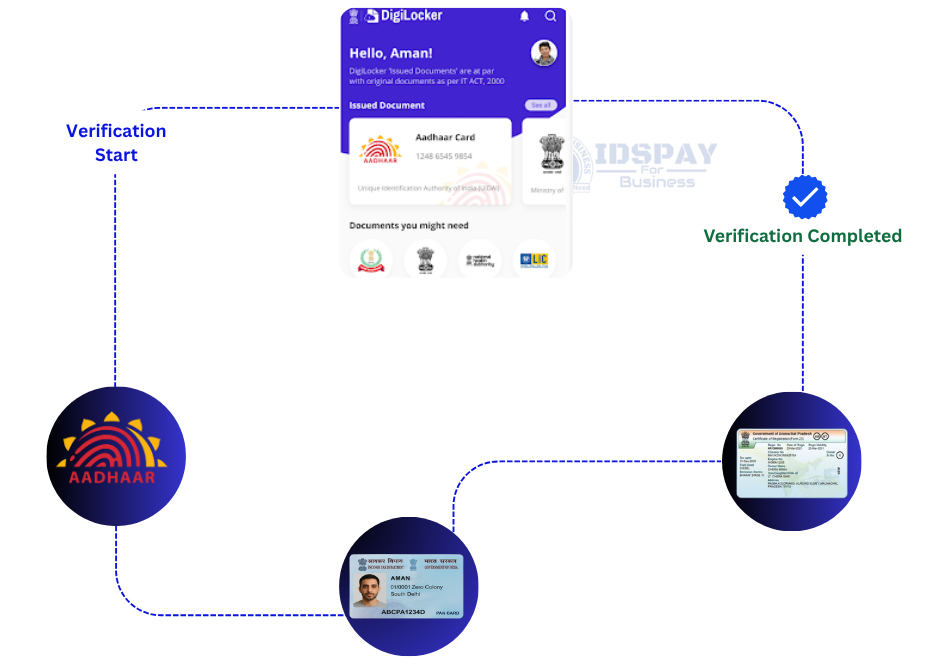

The Credit Score API offered by IDSPay delivers real-time, verified credit Score by mobile number to financial institutions, fintech companies, and lending platforms across India. With this powerful API you can instantly retrieve a borrower’s credit Score directly via secure endpoints. This seamless integration empowers lenders to automate credit on-boarding, enhance risk assessment, reduce defaults, and accelerate decision-making — all while ensuring regulatory compliance and data security.

Whether you are an NBFC, bank, microfinance company or a fintech startup, IDSPay’s Credit Score API helps you embed credit-bureau data into your workflow, streamline your loan origination, and dramatically improve conversion rates.

With easy RESTful integration, high-volume support and developer-friendly documentation, our Credit Score API is the fastest path to unlocking trusted credit intelligence for your business.

Credit scores typically range from 300 to 900, with scores above 750 considered excellent and most favorable for securing credit.

Increases your chances of getting approved for credit cards, personal loans, home loans, and auto loans.

Lenders offer better interest rates to individuals with high credit scores, saving you money over time.

A good credit score can qualify you for higher credit limits on loans and credit cards.

A good credit score reflects financial responsibility and improves your credibility with lenders and service providers.

Credit score is one of the most essential financial indicators in credit systems to assess an individual’s creditworthiness, and hence, having a good credit score is critical for accessing loans, securing better interest rates, and increasing approval chances for credit-related services.

Read MoreAlways pay your credit card bills, EMIs, and other dues before the due date to build a strong repayment history.

Use less than 30% of your total credit limit to show responsible credit usage and avoid negative impact on your score.

Regularly check your credit report for errors or fraudulent activity and raise disputes if needed to keep your score accurate.

Keep old credit accounts open and active—longer credit history improves your credit profile and score over time.

Still have any question? Please contact our sales team

Contact our sales team