Frequently asked questions?

Still have any question? Please contact our sales team

Contact our sales teamA Comprehensive Identity and Business Verification for your business with Enhanced Due Diligence.

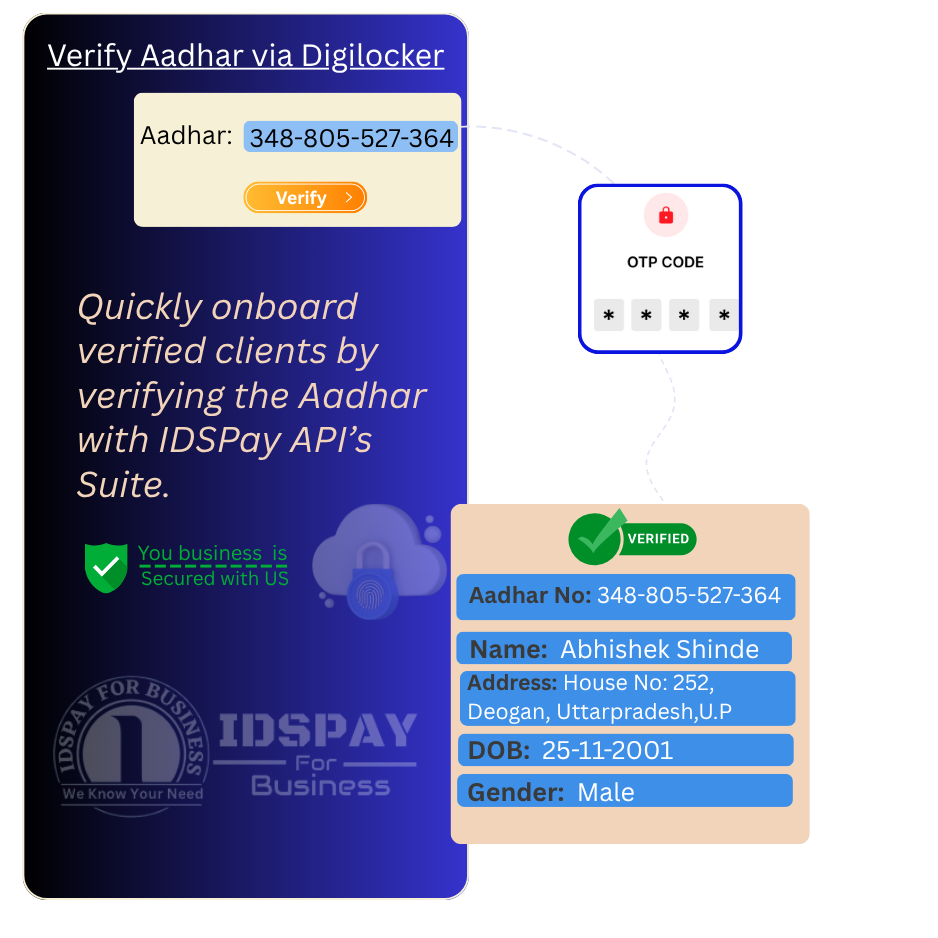

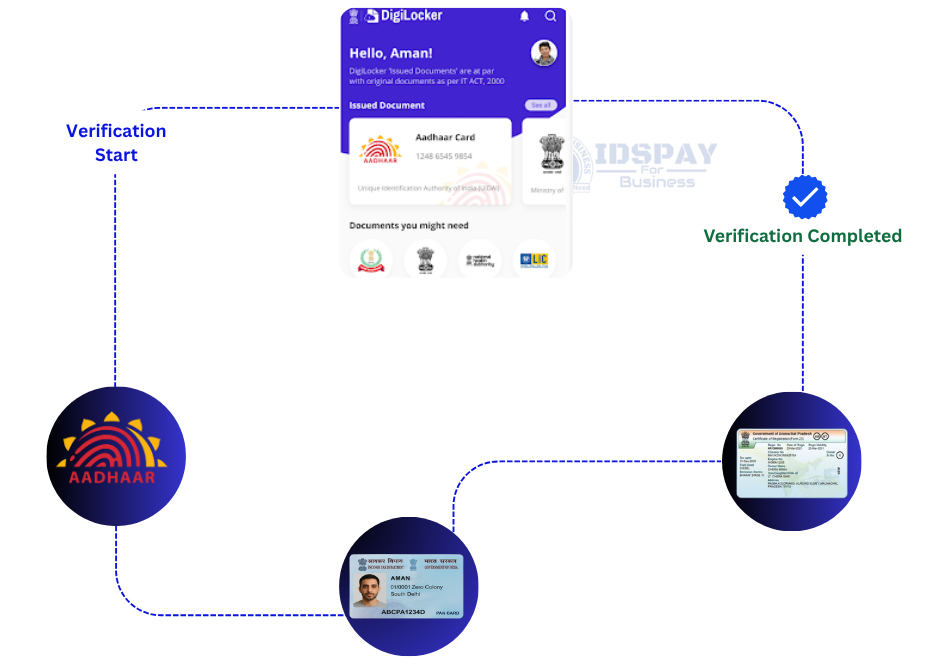

Modern banking systems require secure and privacy-focused identity verification solutions. Our Pan & Aadhaar Masked Reverse Status API enables financial institutions to verify the linkage status between PAN and Aadhaar numbers while masking sensitive data to ensure customer privacy.

This powerful API simplifies and accelerates compliance checks by providing masked, anonymized data for reverse lookup, helping institutions confirm valid PAN-Aadhaar linkage without exposing full identity details—minimizing risk and enhancing data protection.

By digitizing masked verification, banks and fintechs can offer customers a seamless, paperless experience that safeguards sensitive information while ensuring regulatory compliance.

Whether conducting KYC verification, tax-related validations, or customer onboarding, our Pan & Aadhaar Masked Reverse Status API delivers a secure, efficient, and privacy-first workflow.

Empower your digital compliance journey with a scalable, reliable, and developer-friendly masked verification solution designed for today’s data privacy standards.

Masks critical identity details during verification to ensure customer privacy and data security.

Instantly verifies the linkage status between PAN and Aadhaar without exposing full personal data.

Helps detect inconsistencies or unlinked identities, minimizing fraud and identity theft risks.

Supports adherence to government regulations that mandate PAN-Aadhaar linkage verification while maintaining data privacy.

Pan & Aadhaar Masked Reverse Status API is a vital tool for verifying the linkage between PAN and Aadhaar numbers while masking sensitive information. This ensures privacy and data security during the verification process.

Having this masked verification is critical for complying with regulatory requirements, preventing fraud, and enabling secure access to banking services and financial transactions.

Read MorePerforms verification by masking sensitive details, protecting user privacy during PAN-Aadhaar linkage checks.

Provides instant confirmation of whether PAN and Aadhaar numbers are linked.

Helps detect unlinked or mismatched identities, reducing identity fraud risks.

Enables fully digital verification, improving efficiency and customer experience.

Still have any question? Please contact our sales team

Contact our sales team