Frequently asked questions?

Still have any question? Please contact our sales team

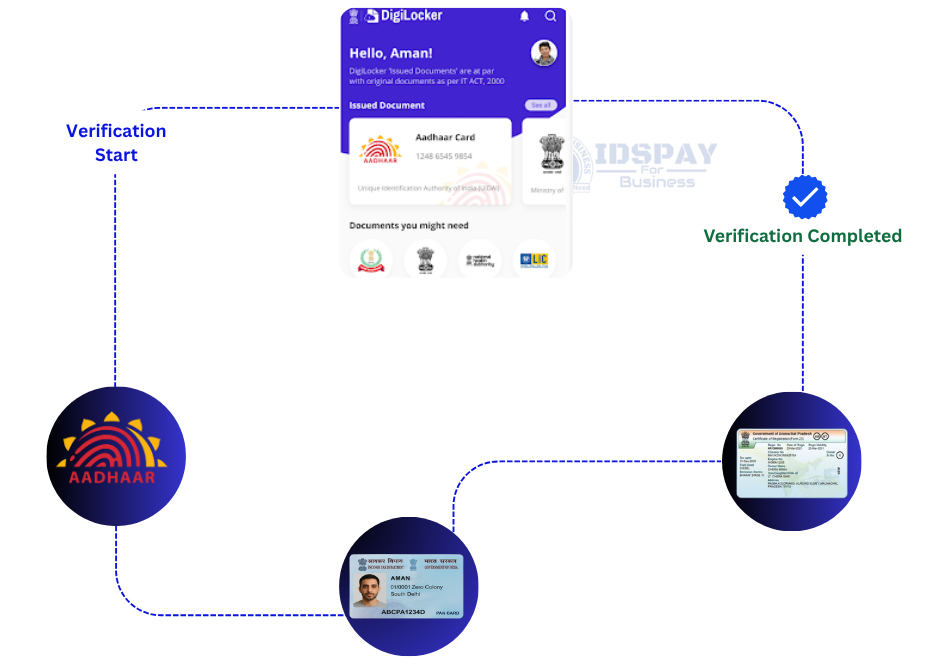

Contact our sales teamA Comprehensive Identity and Business Verification for your business with Enhanced Due Diligence.

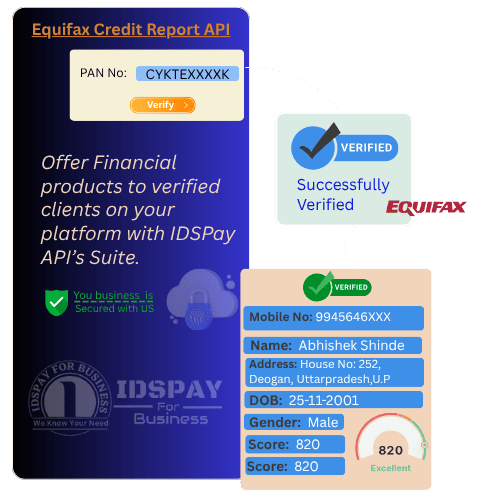

Key Benefits of Using IDSPay’s Equifax Report API

✅️ Verified data directly from Equifax

✅️ 99.9% uptime with secure authentication

✅️ Developer-friendly API documentation

✅️ Ideal for NBFCs, fintech startups, digital lenders, and microfinance companies

The Equifax Credit Report API from IDSPay enables lending platforms, NBFCs and financial services to seamlessly integrate real-time credit bureau data from Equifax India. With this robust API you gain access to comprehensive credit reports, individual credit scores, repayment history, outstanding loans, credit utilisation and inquiry records — all retrieved in seconds.

Ideal for fintech companies and digital lenders, the Equifax Credit Report API supports fast onboarding, precise risk assessment and automation of credit decision-making. Built for security, scalability and compliance, IDSPay’s integration of the Equifax Credit Report API ensures your institution enjoys trusted data, minimal defaults, and superior operational efficiency.

Unlock powerful credit insights with the Equifax Credit Report API to improve risk management and enhance customer experience.

Access up-to-date credit reports and scores instantly for informed decision-making.

Utilizes reliable data directly from Equifax, a leading credit bureau.

Streamlines lending workflows with automated credit report retrieval.

Includes repayment history, loan details, credit utilization, and inquiry records.

The Equifax Credit Report API is a secure, consent-based service that provides real-time access to an individual's credit report and credit score from Equifax, one of India’s leading credit bureaus. It delivers detailed credit information including repayment history, outstanding loans, credit utilization, and recent credit inquiries.

Read MoreProvides real-time retrieval of credit reports and scores from Equifax.

Requires explicit user consent to ensure compliance with regulatory guidelines.

Includes credit score, repayment history, loan accounts, credit utilization, and inquiry records.

Uses Permanent Account Number (PAN) for precise identification and credit report retrieval.

Still have any question? Please contact our sales team

Contact our sales team