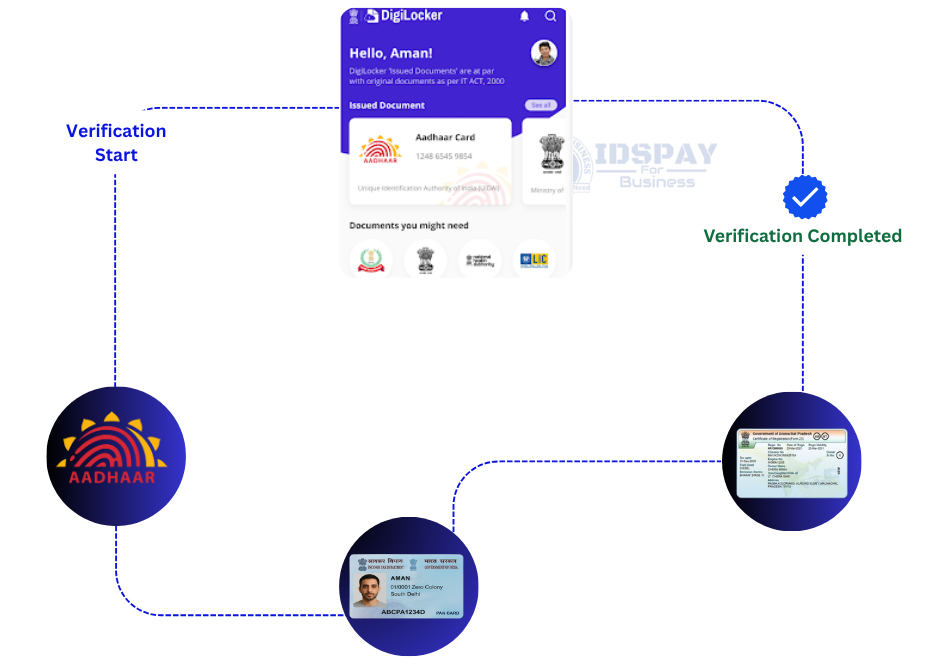

Modern banking systems require swift and accurate identity proofing. Our PAN Card Creation API, integrated seamlessly via DigiLocker, enables financial institutions to digitally generate and issue PAN cards with real-time verification.

This powerful API simplifies and accelerates the PAN card issuance process by automating customer data validation, ensuring compliance with regulatory standards while reducing manual intervention and errors.

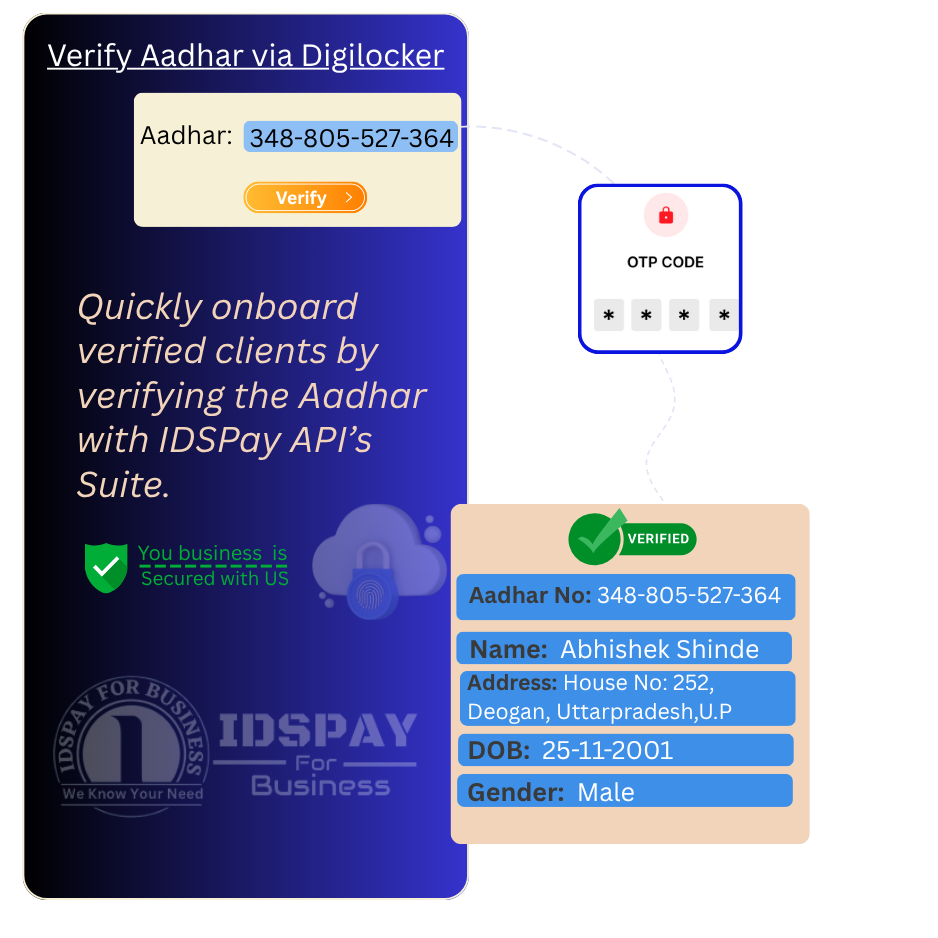

By digitizing PAN card creation, banks and fintechs can offer customers a seamless, paperless experience—validating essential details such as name, date of birth, and Aadhaar linkage to ensure authenticity.

Whether onboarding new customers, facilitating tax compliance, or enabling investment services, our PAN Card Creation API delivers a secure, efficient, and fully digital workflow.

Empower your digital journey with a scalable, reliable, and developer-friendly PAN card issuance solution.